An Early Look at the End of Single-Family Zoning in Spokane

In August 2022, Spokane – a city of around 200,000 people in Washington State – adopted an interim zoning measure as a trial. The Building Opportunity and Choices for All Act (BOCA), was implemented for a year, temporarily abolishing single-family zoning and allowing the construction of up to fourplexes city-wide.

The trial represents another policy experiment to observe the impacts of zoning reform on new housing supply after success in both Auckland and Minneapolis, who both abolished single-family zoning prior to Spokane.

The policy being initially introduced as a trial is unique. A downside is that builders might be hesitant to adapt to a temporary change in rules, particularly as they may be inexperienced at efficiently building ‘plexes’. On the other hand, if for some reason landbanking actually occurs in suburban housing markets, the short-term nature of the policy may incentivise developers to expedite their processes.

Regardless, BOCA did not remain a trial for long. After six months it was extended until the end of 2023, and is now in the the process of being made permanent ahead of broader upzoning reforms being adopted across Washington State, which will affect Spokane from 2026.

So, one year on, it’s time to look at how the Spokane reforms have gone, and how they have affected supply. The usual caveats apply with this analysis: we’re looking at time series data and not undertaking robust or causal analysis (which has been done in Auckland). So we have to be careful about strong claims, and be open to a variety of explanations.

The story so far is promising…

Whenever analysing housing supply data in the U.S., I first look at HUD data on dwelling permits as these are reliable and comparable across regions.

At a high-level, Spokane has been effective at building housing over the past year. As of June of this year Spokane had approved 637 new units, 536 of them being multi-unit. That’s already more than last year, and if we make a simple assumption that this rate will continue for the back half of the year, it will more than double it.

While impressive, we can’t attribute all of this to the new zoning reforms. Most of this new supply – around 77% - has been for denser apartment buildings of 5 plus units, rather than plexes. The City Government has encouraged multi-unit construction through a tax concession over this period though, so policy may take some of the credit. There’s also likely another unobserved variable at play: most housing regulations are subject to interpretation, so a pro-housing government may be lax applying their existing restrictions for dense developments.

Zoning reform does appear to be having some effect on plex construction. Prior to BOCA, Spokane added almost no plex housing – just 27 units per year on average. That’s changed markedly under the program, almost tripling to 70 according to the city. That’s more than any year since at least 1995.

This is compounded by the city relaxing restrictions on Accessory Dwelling Unit construction, allowing them to be larger and removing a requirement that the property owner must live on site to develop them. ADU approvals have grown from 12 in 2020 to 44 already in 2023. When we combine plexes and ADU’s together, they represent a growing portion of Spokane’s supply stream, around 13% of new construction in 2023, up from around 7% just three years prior.

So, from an initial look, the reforms in Spokane seem strong, and likely helpful at helping add new housing, but hardly as revolutionary as in Auckland. They seem somewhere closer to the abolition of single-family zoning in Minneapolis.

I’ve written about the Minneapolis reforms before, upzoning single family areas there has seen plex construction increase around 40%, but they still only total around 2% of total supply, and are on track for around 68 units this year. There, the abolition of car-parking requirements, a pro-housing government, and ADU reform were likely more important to increasing supply.

Spokane’s reforms have had more of an immediate impact than Minneapolis’, and have perhaps already been more successful. But, to some, they may seem just a modest influence on increasing housing supply. That is, until we dig a little deeper.

.. and it’s not done yet

In researching the housing reforms in Spokane two things stood out to me as highly promising. First, the discourse surrounding the Spokane’s single-family zoning reforms is a lot more positive than Minneapolis, despite producing only slightly better results thus far. Second, the program’s website indicated that although 70 dwellings had been approved, many more were in pre-development.

As of May, 425 units were listed as being in ‘Pre-Development’. According to the City, Pre-Development is an early step in the process that involves developers and landowners meeting with the City and Governmental agencies to determine project feasibility and provide an overview of requirements. They are not a project submittal, and some projects may not move forward, but many require just more feasibility analysis and revisions to proceed.

So, we can maybe think of these pre-development applications as somewhere between formal interest in plex development, and the first stage of the actual development process.

Perhaps the gap between pre-development units and approvals isn’t surprising, these reforms are new and so developers may need to learn how they can work with them. Plex construction requires different techniques from single-family or apartment construction. Even Auckland took a few years to fully ramp up in response to reforms.

To better understand these prospective units in pre-development, I went into the raw building permits data published by the City of Spokane. The data, like most admin data, are messy: most applications specified number of new units and the type of plex, while others only stated ‘new construction’ or ‘multifamily’.

I made some conservative assumptions in cutting the data – I only selected applications that specified that a fourplex or lower was being applied for, specified the number of units. Where applications were unclear, I dropped them or took a lower bound estimate. In general, the numbers presented below should be considered an underestimate of the true number of pre-development applications – I found 275 specified developments, lower than the 425 on the city’s website. Regardless, they present insights into the types of applications, and their rate.

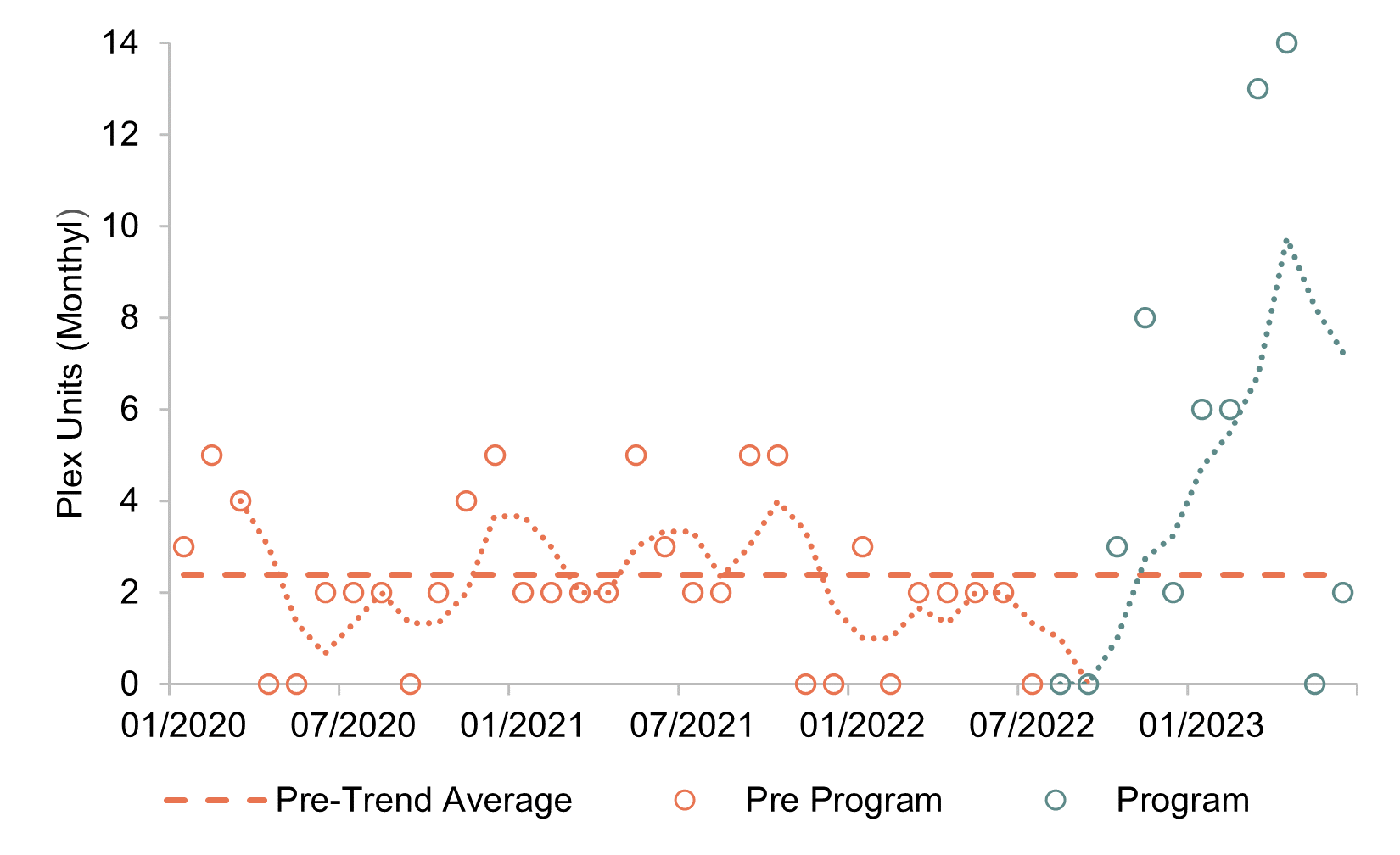

Applications follow a seasonal pattern (being lower during the winter), but the raw figures are remarkable. To gauge some form of ‘counterfactual’, I’ve added a ‘pre-trend’ line of 2.4 units a month, which is the amount of plex development in an average month prior to reform. It’s probably not entirely fair to compare actual development to these pre-development figures, but it is still quite striking to see how out of the norm this is for Spokane.

425 plex units represents just shy of 15 years worth of average plex supply in Spokane, in just one year of the reform being in place. It’s more than the total housing supply in 2019.

It’s uncertain how many of these units will actually be developed, but its clear that there is demand, or at least strong interest, in denser housing opportunities now that single-family zoning is not in the way. If we are conservative, and say just half of these units are developed at an even rate the next three years, that’s still 70 units a year, or 12% of housing supply in 2022. And that’s assuming that there are no more applications. As developers improve their skillsets at building plexes, and work out how to engage with the new zoning laws, applications may increase further.

What else can we learn about these applications?

Most units (86%) are part of fourplex applications, suggesting that developers prefer the densest option available.

Pre-development applications are quite varied in size, from some having 5+ fourplexes, to others which are just adding another unit to an existing structure.

According to the city, a potential issue with developments so far may relate to high demolition costs. From some unscientific analysis of the locations of applications, it seems to me that many fourplexes are being proposed on large blocks with existing space, where development may be quicker and easier. See below for a google street view of one proposed development site for a fourplex. This will probably be typical of the short-run response to the policy.

Spokane is also adopting parking reforms, abolishing minimum parking requirements close to transport, which based upon the existing evidence will add further fuel to the housing supply fire.

This is all still early, and maybe it will not materialise as strongly as indicated above, so we will need to watch outcomes closely going forward closely. This is why I’m adding a third location-tracking page to this site, where I will report on supply, rents, prices, and other outcomes in Spokane to bring more evidence to the debate about upzoning reforms. You can find a link at the top of the page, or here.

Regardless, it seems that Spokane is yet more evidence that zoning restrictions are binding, and reducing them can help increase supply.